Price and Output Decisions under different Market Perfect Competition Monopoly and Monopolistic Competition Oligopoly. Each firm sells a virtually identical product.

Price And Output Determination Under Perfect Competition

In competition output is pressed to the point where marginal cost equals the market price.

. Cases per week per case per case PER CASE 150 600 880 1650. Group of answer choices Buyers and sellers are price takers. If youre seeing this message it means were having trouble loading external resources on our website.

The profit is maximized when. Determining Price and Output under Monopoly. Prices are the lowest sustainable price possible.

Output Marginal Cost AVC ATC. In perfect competition any profit-maximizing producer has a market price equal to its marginal cost PMC. An increase in the market demand for oats from D 1 to D 2 in Panel a shifts the equilibrium solution to point B.

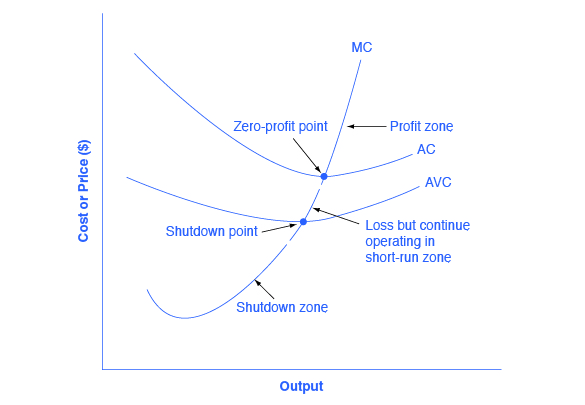

When demand falls firms will operate at a loss until enough firms leave the market causing supply to fall and price to return to equilibrium. Start up costs and technology lots of training and know-how describe prices and output in a perfectly planned competitive market. Monopolistic Competitive Market Pricing Strategy.

200 640 780 1360. Describe prices and output in a perfectly competitive market. MC MR MC curve must cut MR curve from below.

All buyers and sellers can freely and immediately enter or leave the market. If the market price received by a perfectly competitive firm leads it to produce at a quantity where the price is greater than average cost the firm will earn profits. Example of Optimal Price and Output in Perfectly Competitive Markets.

Suppliers can only supply what the consumers can consume at given prices. Further the input and cost conditions are given. Features of Perfectly Competitive Market The following seven features characterize perfectly competitive free markets.

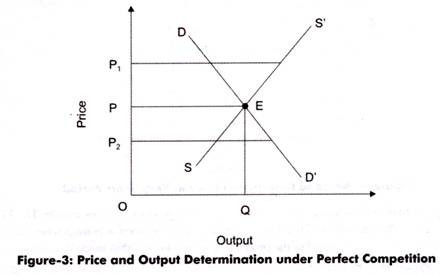

We know that a firm is in equilibrium when its profits are maximum which relies on the cost and revenue. The initial equilibrium price and output are determined in the market for oats by the intersection of demand and supply at point A in Panel a. See examples of how perfectly competitive firms decide how much to produce.

If we treat the marginal cost of the monopolist as the counterpart of the aggregate marginal cost of the competitive industry its intersection with the market demand curve gives us the competitive market price and sales. Business managers are expected to make perfect decisions based on their knowledge and judgment. Short run is defined as a period of time when at least one input is fixed.

Therefore the firm can alter the quantity of its output without changing the price of the product. A Here please describe the competitive market for gasoline using the competitive model. In a perfectly competitive market structure the market sets the price and firms are merely price takers and therefore operate for as long as production costs fall below revenue.

Which of the following statements does not describe a perfectly competitive market. Hence the output that offers maximum profit to a firm is the equilibrium output. Price determination is one of the most crucial aspects in economics.

Since every economic activity in the market is measured as per. Assume the firm starts with profit - 50 and the market price is 300 Assume each gas station produces 500 of output to start. Economics questions and answers.

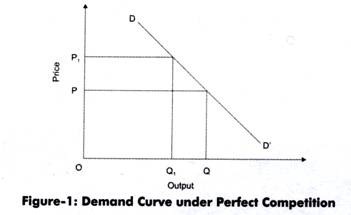

In a competitive market firms are price-takers. E Price elasticity of demand. This is why the demand curve.

If the price function P 20 Q and MC 5 2Q calculate the profit-maximizing price and output. In a perfectly competitive market where the product is homogeneous and the price is determined by the market forces the quantity of output to be produced alters the profit. A firm is in equilibrium when it maximizes its profits.

Therefore the farmer can sell as much wheat as he wishes at the market price but cannot sell any at a higher price because there is no demand for it. There are numerous buyers and sellers none of whom has a substantial share of the market. Equilibrium of the Firm under Perfect Competition.

MC AR e-1e Exhibit-2. In perfectly competitive markets there is no differentiation of products making the firms that reside in these market price takers. If the price received by the firm causes it to produce at a quantity where price equals average cost which occurs at the minimum point of the AC curve then the firm earns zero profits.

In a perfectly competitive market a firm cannot change the price of a product by modifying the quantity of its output. Entry to the market is limited. Price-Output Determination Given the conditions of perfect competition the market price is determined by the market forces Market demand and Market Supply The firm in a perfectly competitive market is a Price-taker not a Price-Maker Price Determination Rule.

When a firm is in equilibrium there is no reason to increase or decrease the output. As in equilibrium MRMC. Each firm chooses an output level that maximizes profits.

The market is perfectly competitive with constant input prices and each firm has the same cost structure described by the following table. Output is where the supplying firms can cover all their costs and. By signing up youll get thousands of step-by-step solutions to your.

Labelling all the cost curves and market supply and demand. The price increases in the short run from 170 per bushel to 230. Set up a short run perfectly competitive market model graph.

In perfectly competitive markets firms are price takers and thus are bound to the price as dictated by market demand.

Price And Output Determination Under Perfect Competition

Reading Price And Revenue In A Perfectly Competitive Industry And Firm Microeconomics

8 2 How Perfectly Competitive Firms Make Output Decisions Principles Of Economics

0 Comments